Log of Some Marathon Running: Marathons London Marathon 2003 4 hours 57 mins 09 secs London Marathon 2006 4hrs 3 mins 58 secs Leicester Marathon

Podcast

I have a regular podcast series called ‘The Knowledge – with Professor Graham Squires’ Take a look on Spotify or Apple Podcasts and if you

YouTube Channel

I post videos on YouTube. Take a look and if you are interested please Subscribe Here https://www.youtube.com/@GrahamSquires/ Listen: YouTube | Apple Podcasts | Spotify

New Book – The Economics of Property and Planning: Relevance and Importance

Given the imminent release of my new book ‘The Economics of Property and Planning’, here is some text on the book’s relevance and importance. Both

Read MoreNew Book – The Economics of Property and Planning: Relevance and Importance

Economic Geography and Space

Ideas of place in the economics property and planning cannot escape the concepts of space and spatial considerations held with economic geography. Space as a

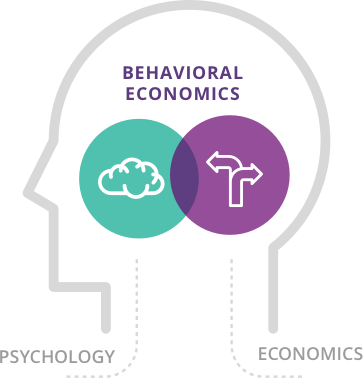

Institutional and behavioural economics

It can be seen that classical economic thought on property and planning is relatively young with writers dating back to the 18th century. This is

Our New Book: Construction Procurement. What is it about?

A bit likes buses, I have 2 books coming out at the end of the year with publishing dates 2022. This book is an easy-to-read

Read MoreOur New Book: Construction Procurement. What is it about?

On Afghanistan – Part 2: Is it possible to parachute a democratic system on a tribal model?

Here is the second of my ‘On Afghanistan’ posts that delve into some interesting Political-Economy of one of the poorest places on earth. Here we

Read MoreOn Afghanistan – Part 2: Is it possible to parachute a democratic system on a tribal model?

New Paperback Version – Routledge Companion to Real Estate Development. (2021). 29 Chapters. 43 Authors.

Good news for those interested in theory-practice of Real Estate Development. Our edited book has been published as a much more ‘affordable’ paperback. Also an

Transit-Oriented Development (TOD) – A Primer.

Here we consider the emergent role of transit-oriented development (TOD) that is playing a role in ‘future value’ whilst dealing with environmental resource and place-based

On Afghanistan – Part 1: Can an imposed liberal democratic system and ‘humanitarian intervention’ give stability and peace?

This may be slightly out of the left field. I’ve been interested in the progress and poverty of the disadvantaged for many decades now. As

Transport and Infrastructure Economics in Property and Planning

It is quite widely thought that the role of infrastructure, particularly transport, is one useful way to understand the history of places. Particularly by looking

Read MoreTransport and Infrastructure Economics in Property and Planning

On Justice in Property and Planning – Normative Economics in Action

For economics in property, the legal real property consideration of justice resonates in economics and the economy. Early writers on justice such as Paine (1797)

Read MoreOn Justice in Property and Planning – Normative Economics in Action

Making clear the inflation question – what does this mean for planning ‘property’?

Stable prices are a macroeconomic consideration for nations and the places contained within their boundaries. For places, changes in inflation or changes in the prices

Read MoreMaking clear the inflation question – what does this mean for planning ‘property’?

Brownfield Development: Some Historical Context, Barriers, and Issues

Brownfield sites can generate negative externality on real estate value, profit, and productivity. The use and development of brownfield sites are perceived to be risky

Read MoreBrownfield Development: Some Historical Context, Barriers, and Issues

Financialization and Property

The contribution of financialization discourse to capital and inequality is particularly interesting to economics in property. Epstein’s (2005) ‘Financialization and The World Economy’ opens more

On the Environment and Environmentalism

What is an Environment? The meaning of an environment needs some short attention in order to frame understanding in this space. More broadly the environment

What is Urban? Fundamentals to growing and shrinking cities

There are several conversations going on that consider the growth and decline of cities given their changing function in a Covid world. Such as why

Read MoreWhat is Urban? Fundamentals to growing and shrinking cities

Higher insurance bills, lower house values: Flooding can have long-term impact

There is a warning flood-hit homeowners face financial costs long after the water has receded. Insurers are becoming increasingly sensitive to flood risk, which means

Read MoreHigher insurance bills, lower house values: Flooding can have long-term impact

Housing Affordability and Tenure Change – Generation Rent

Housing affordability as a rental tenure issue has become an increasingly debated area. Particularly as it can be argued that there has been an increasing

Read MoreHousing Affordability and Tenure Change – Generation Rent

David Ricardo on Land Rents and Comparative Advantage

To deal with the economic issues of property, the work by David Ricardo (1772 – 1823) provides a dimension on how trade and the relative

Read MoreDavid Ricardo on Land Rents and Comparative Advantage

Why does the value of money erode? Human Nature, Time, and Discounting

For major project feasibility and decision making, if cost and benefit items have been identified and valued, the net difference of costs and benefits need

Read MoreWhy does the value of money erode? Human Nature, Time, and Discounting

Innovative infrastructure funding needed for affordable homes

The infrastructure levy introduced last year is a start but New Zealand is behind its contemporaries. Massey University economics professor Graham Squires More weight needs

Read MoreInnovative infrastructure funding needed for affordable homes

Could Public Private Partnerships help solve the infrastructure and housing crisis?

Innovative finance for PPPs in real estate development will be critical to developing quality infrastructure and homes for New Zealanders, Professor Graham Squires says. Professor

Read MoreCould Public Private Partnerships help solve the infrastructure and housing crisis?

The Malthusian Problem of Feeding a Population

Thomas Malthus (1766-1834) was one writer who took concerns of economic growth and population rise as a consequence of the industrial revolution and extrapolated via

Regressing into Regressions – A checklist

The definitions given here are designed to understand the more technical parts of statistical regression analysis. I often find this type of work can help

Building a case for ‘build-to-rent’ developments

As the Government tightens rules for property investors, it’s talking up a less common type of rental development. What are ‘build-to-rent’ schemes, and how could

The Problem with an Economic Valuation of the Environment

The valuation of external costs and benefits will be difficult but necessary if the full cost or benefit to society and the environment is to

Read MoreThe Problem with an Economic Valuation of the Environment

The Economics of Choice and Opportunity Cost in Development

Choice is an important element in economic thinking if there are scarce resources and infinite wants. Places that are booming will have to make choices,

Read MoreThe Economics of Choice and Opportunity Cost in Development

Affordable Housing using Direct Regulation and Bonds

The discovery of what specific policy mechanisms can be used to finance affordable housing is extremely helpful. Different ‘types’ of mechanisms are available in the

Read MoreAffordable Housing using Direct Regulation and Bonds

Mixing Types of Mechanisms – Process, Tiers, Weights and Blends

The mechanisms highlighted in supporting affordable housing finance and funding only serve to demonstrate financial forces that shape the market. Often it is the process

How do we do international research?: Some Methods in studying ‘Real World’ phenomena

[1500 Words; 8 Minute Read] In this post, we focus on the importance of methods to aid international ‘real world’ research. Natural sciences often place

Read MoreHow do we do international research?: Some Methods in studying ‘Real World’ phenomena

The Private Finance Initiative (PFI) – Paying for Public Goods with Private Money

[2000 Words; 10 minute Read] The Private Finance Initiative (PFI) is defined as a form of procurement to encourage private investment in public sector projects.

Read MoreThe Private Finance Initiative (PFI) – Paying for Public Goods with Private Money

The Open Economy and Sustainable Cities

[1000 Words; 10 Minute Read] In addition to the more localised economic mechanisms that operate in urban areas, the wider open economy will shape how

Financing Affordable Housing – Some Fiscal Approaches used in the United States

[2000 Words; 10 Minute Read] It is important to improve understanding of how cities can be better financed to meet affordable housing challenges over the

Read MoreFinancing Affordable Housing – Some Fiscal Approaches used in the United States

Case study research – using case studies by geography

[800 Words; 5 Minute Read] Research methodology often incorporates case studies, and it is important to outline case study epistemological merits and limitations. Firstly, the

Read MoreCase study research – using case studies by geography

Public Private Partnerships (PPP) – A win-win situation?

[1000 Words; 5 Minute Read] A Public Private Partnership (PPP) is a public service or private business venture that is funded and operated through a

Read MorePublic Private Partnerships (PPP) – A win-win situation?

The Economics of Water – Cost, Price and Value of a ‘Free’ Natural Resource

[1500 Words; 10 Minute Read] This article looks at ‘environmental resource’ issues in connection with water. We look at ‘externalities’ as the third-party costs and

Policy Transfer: Why do we see the same ideas and practice around the world? – 5 Key Aspects

[1300 Words; 10 Minute Read]. The post explores what is involved and could be considered when transferring policy from one context to another. At the

Sustainable Urban Development – Connecting Urban and Environmental Economics

[1200 Words; 4 Minute Read] Concern over climate change and a focus to improve and protect natural resources and improve ecological health have been promoted

Read MoreSustainable Urban Development – Connecting Urban and Environmental Economics

Affordable Housing – a Community Reinvestment Solution?

[2000 Words; 15 Minute Read] Policy in affordable housing supply is responding to the challenge of housing markets where unaffordability prevails. Often measured by high

Read MoreAffordable Housing – a Community Reinvestment Solution?

How can you Value the Built and Natural Environment? Cost-Benefit Analysis

[2000 Words; 20 Minute Read] There are forms of market failure due to external costs and benefits that need to be calculated and internalized to

Read MoreHow can you Value the Built and Natural Environment? Cost-Benefit Analysis

Housing Affordability Determinants

[1100 Words; 4 Minute Read] “Decent, affordable housing is fundamental to the health and well-being of people and to the smooth functioning of economies” (Woetzel

Critical Realism as a Research Philosophy – Enlightened Common Sense?

In order to frame research within a particular philosophy a critical realist approach can be taken, especially to gain a greater understanding of causality. Ontological

Read MoreCritical Realism as a Research Philosophy – Enlightened Common Sense?

Why will Globalisation prevail? The enduring forces and enablers

In discussing globalisation, the term can be described as the convergence of markets, economies and ways of life across the world. A broad overview definition

Read MoreWhy will Globalisation prevail? The enduring forces and enablers

Housing Development and Design in Cities

Introduction [3000 Words; 23 Minute Read] The last few decades globally has seen a move away from seeing housing design as part of the development

Financing Affordable Housing Development – Mechanisms that are Weighted and Blended

[1000 Words; 10 Minute Read] This post looks at what “Weighted-Blended” Finance Mechanisms are the most appropriate framing to consider the financing of affordable housing

Socially Responsible Property Investment (SRPI) – Practice, Priorities and Behaviours

[2000 Words; 20 Minute Read] In examining the effectiveness of the investment practice known as ‘Socially Responsible Property Investment’ (SRPI), funds and developers make special

Project Feasibility Given the Time Value of Money: Discounting and Net Present Value

Time and Discounting [2500 Words; 20 Minute Read] For major project feasibility and decision making, if cost and benefit items have been identified and valued,

Financing affordable housing development – What types are there?

[3500 Words; 20 Minute Read] It is important to improve understanding of how cities can be better financed to meet affordable housing challenges over the

The Built and Natural Environment According to Economists – The Early Years.

[3100 Words; Reading Time 24 Mins] Ideas, concepts and theories are developed from intellectual thoughts that are of importance when studying urban and environmental economics.

Read MoreThe Built and Natural Environment According to Economists – The Early Years.

Socially Responsible Property Investment (SRPI) – An Introduction

[1500 Words; 20 Minute Read] This article introduces an understanding of the use of Socially Responsible Property Investment (SRPI) in urban development. Urban development and

Read MoreSocially Responsible Property Investment (SRPI) – An Introduction

Financing urban development

[5,000 Words; 30 Minute Read] The use of bonded financial mechanisms such as Tax Increment Financing (TIF) can lever renewal within a wider policy framework.

Research Reports – Full Archive List

Squires, G., and Susnjak, T. (2020). Machine Learning for Real Estate and Housing Markets. The Property Foundation Squires, G. (2020). The use of housing charges

Build to rent: the pros and cons

Article in RNZ relating to a series of industry seminars that myself and colleague David White ran on Build to Rent in New Zealand As

A PhD on Housing Markets and Regeneration. 10+ years on with Download

Time flies when you are an academic. 10+ years ago I completed a PhD from the University of Manchester (UK), that predominantly focused on exploring

Brains are for having ideas, not storing them

Building a 2nd Brain and Personal Knowledge Management (PKM) In the new pedagogical landscape, I am looking at the limits of teaching and learning as

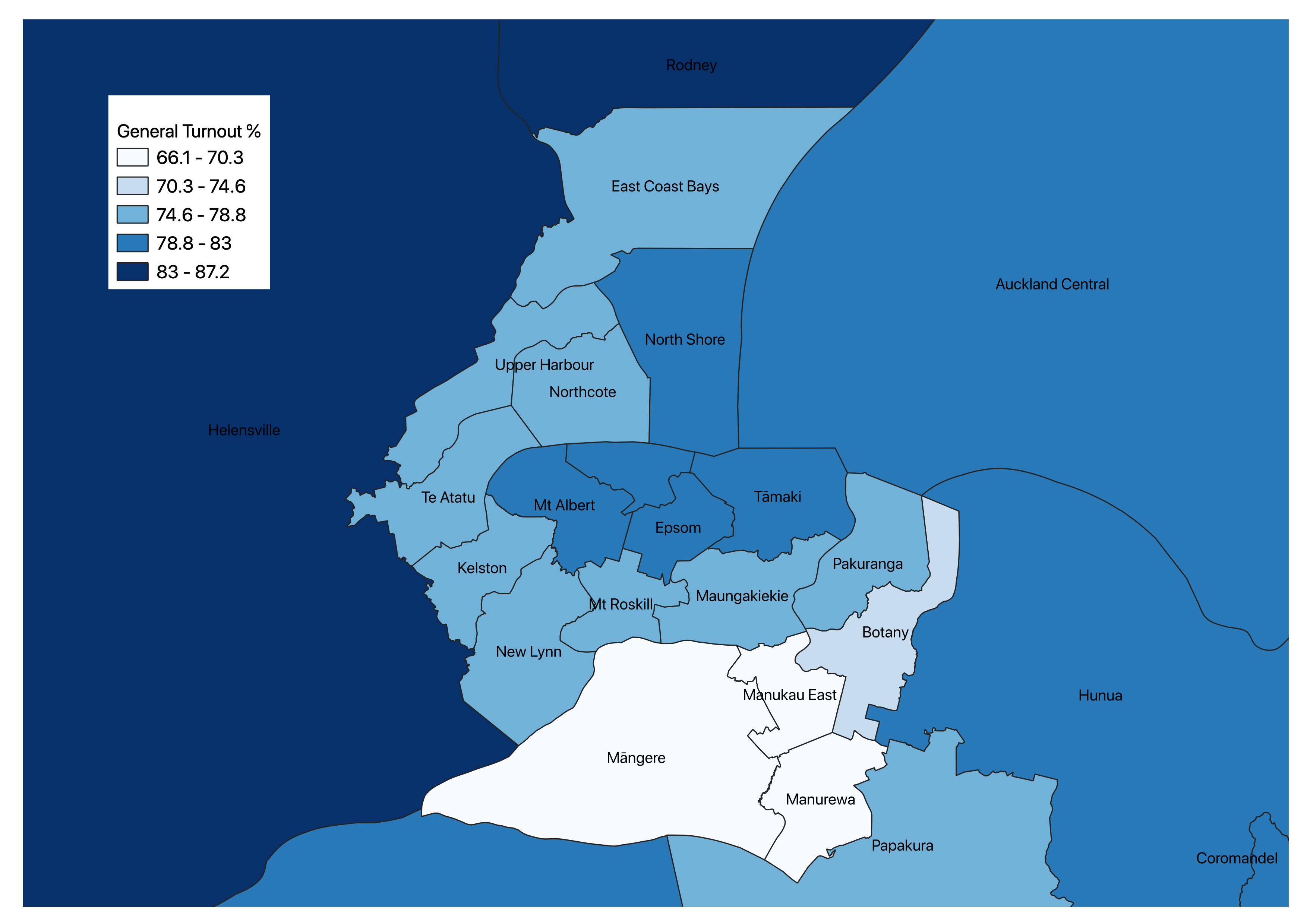

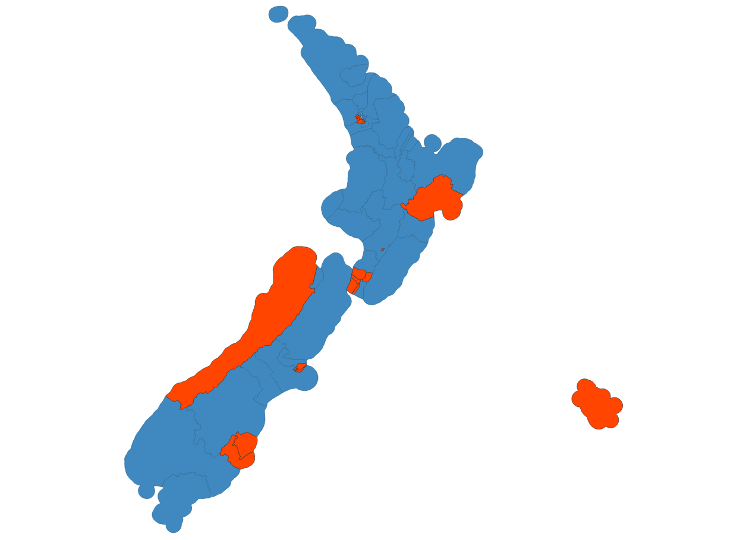

Don’t vote! It only encourages them: Party Votes and Turnout by Electorate

In the lead up to the New Zealand 2020 election it is worthwhile having a look at what proportion of people bother to vote. Here

Read MoreDon’t vote! It only encourages them: Party Votes and Turnout by Electorate

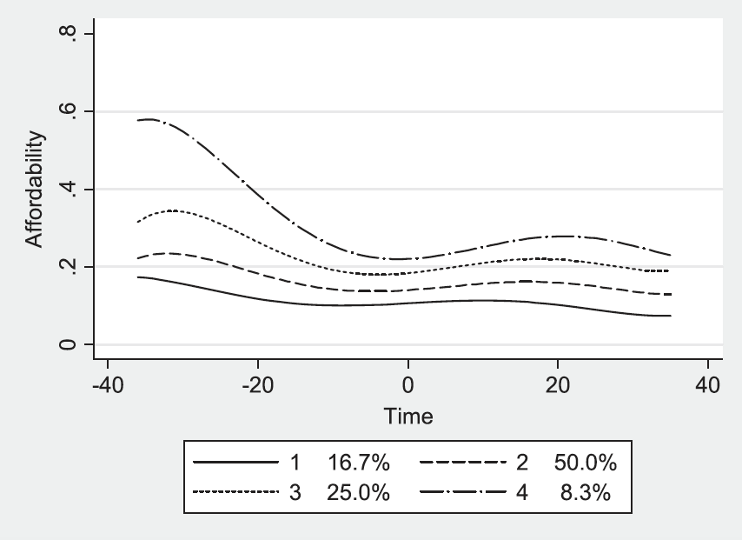

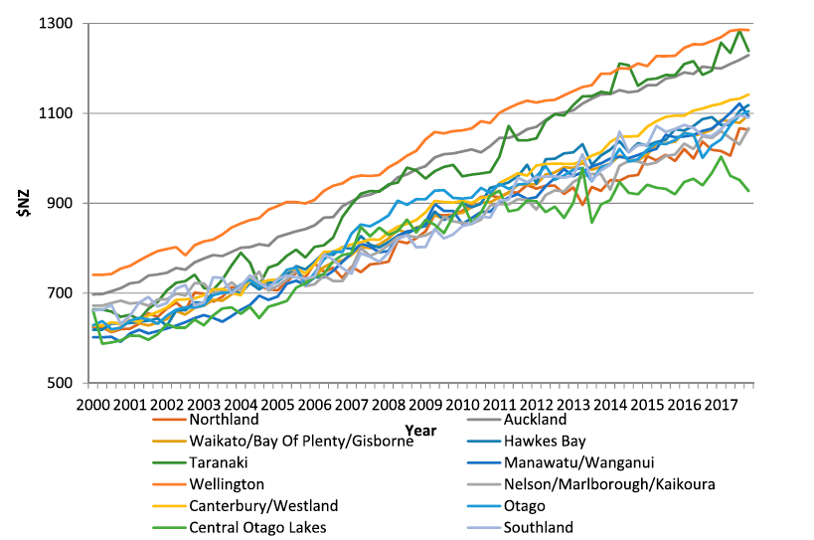

Housing Affordability in the Regions as Trajectory Regressions – If you are into this kind of thing.

I did some work looking housing affordability trajectories in New Zealand’s regions. All very techy, but essentially evidencing how 4 clustered regions have converged in

How to win an Election: New Zealand 2017 Analysis

Here we find some initial analysis that I’ve done looking retrospectively on the 2017 election in New Zealand. Its thrown up some interesting aspects that

No surprises: Wages haven’t kept up with runaway house prices. Some evidence.

Over the last few years, I’ve spent some time looking at and engaging with the affordability debate. For New Zealand, it is a significant but

Read MoreNo surprises: Wages haven’t kept up with runaway house prices. Some evidence.

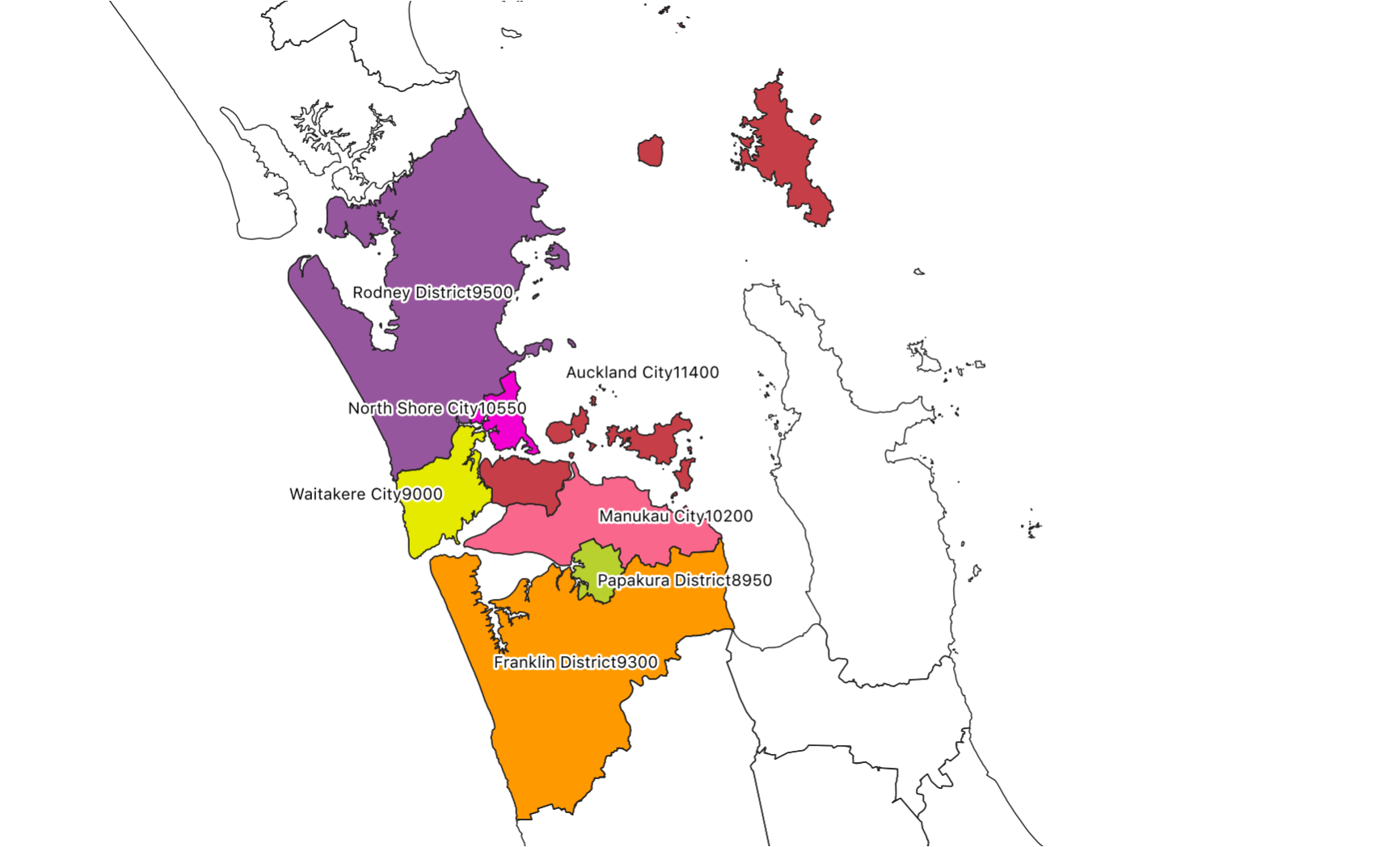

Playing with QGIS: What were Land Values worth in Auckland 2017?

Fast forward 36 years and we see the land value of sales in Auckland’s districts skyrocket. Auckland city at median land value of $500,000 (previously

Read MorePlaying with QGIS: What were Land Values worth in Auckland 2017?

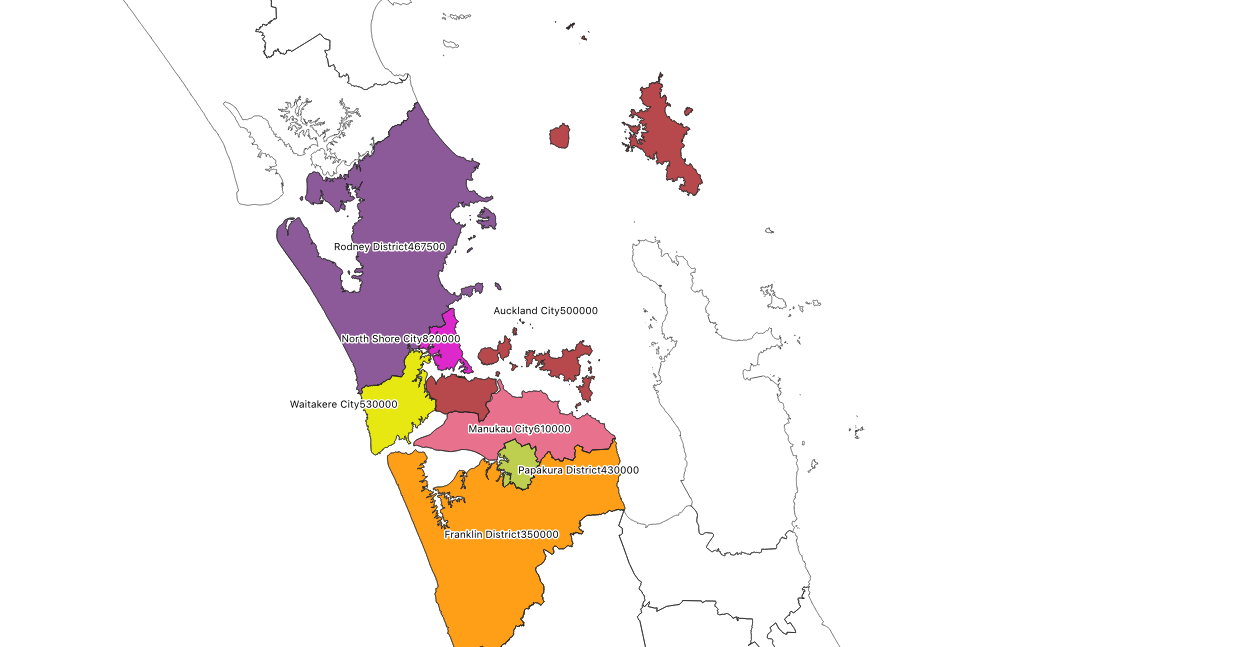

Playing with QGIS: What were Land Values worth in Auckland 1981?

In playing around with QGIS for another project I’ve mapped Auckland district median land values as of 1981. Auckland City land values at a mere

Read MorePlaying with QGIS: What were Land Values worth in Auckland 1981?

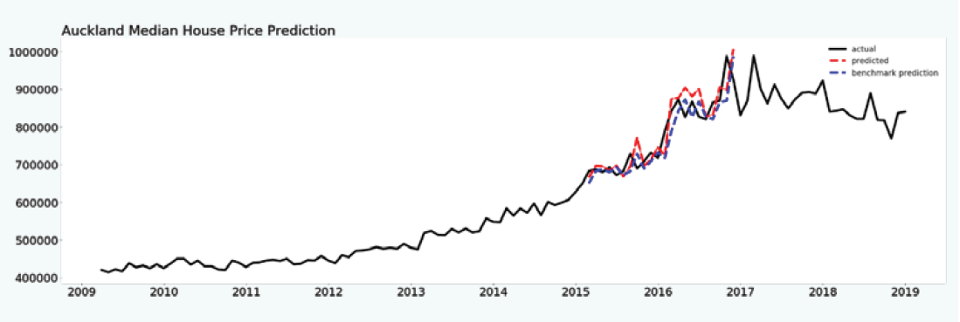

Gazing into the Crystal Ball: Machine learning to predict house prices

Here’s an excerpt from on recent research project on Machine Learning for Real Estate and Housing Markets… “…Here we consider all 21 national-level indicators and

Read MoreGazing into the Crystal Ball: Machine learning to predict house prices

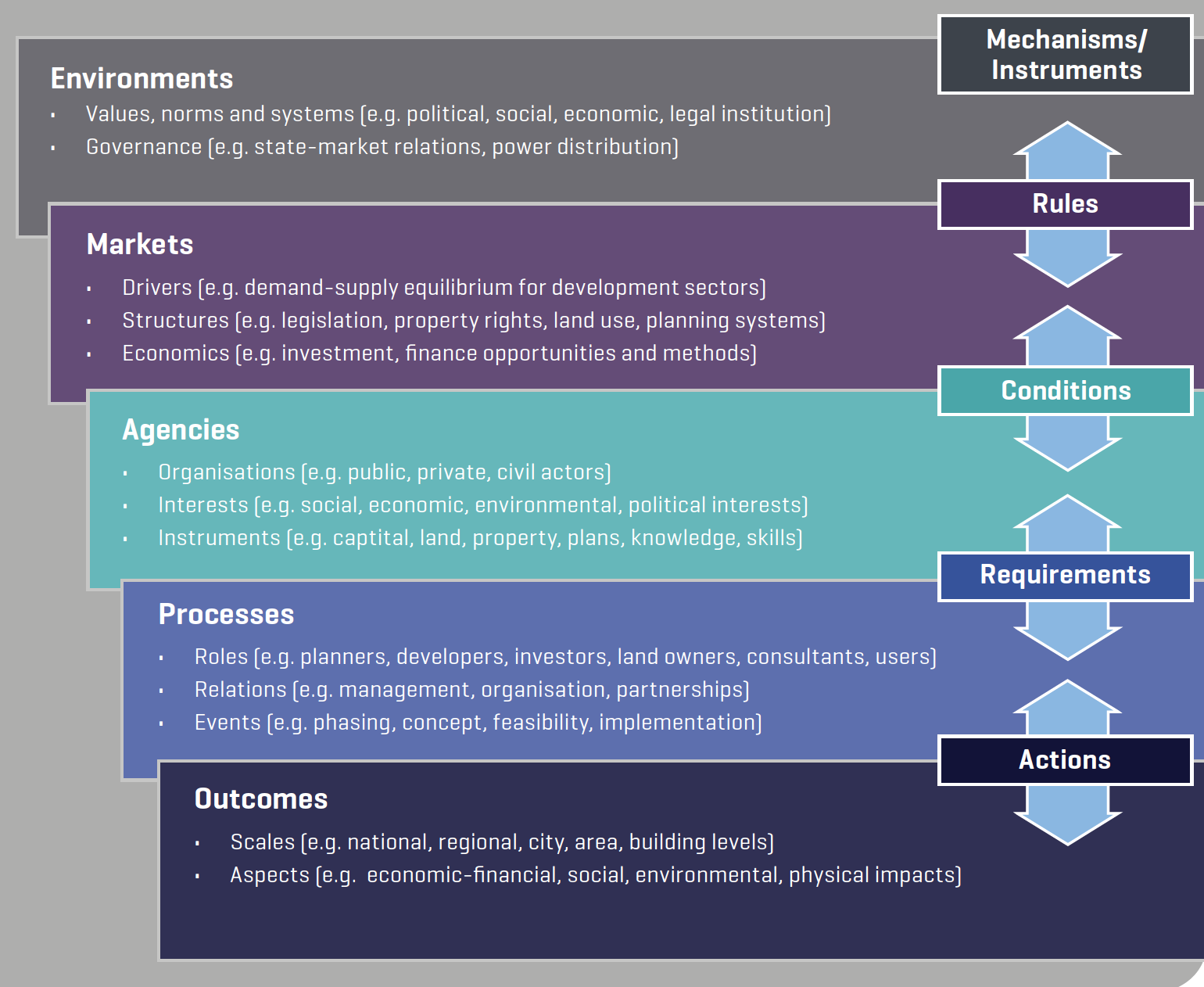

An ‘innovative’ framework for comparing real estate development

Approaches to international comparative analysis of real estate development can be used to bring out some comparisons in case study sites. Key layers and mechanisms

Read MoreAn ‘innovative’ framework for comparing real estate development

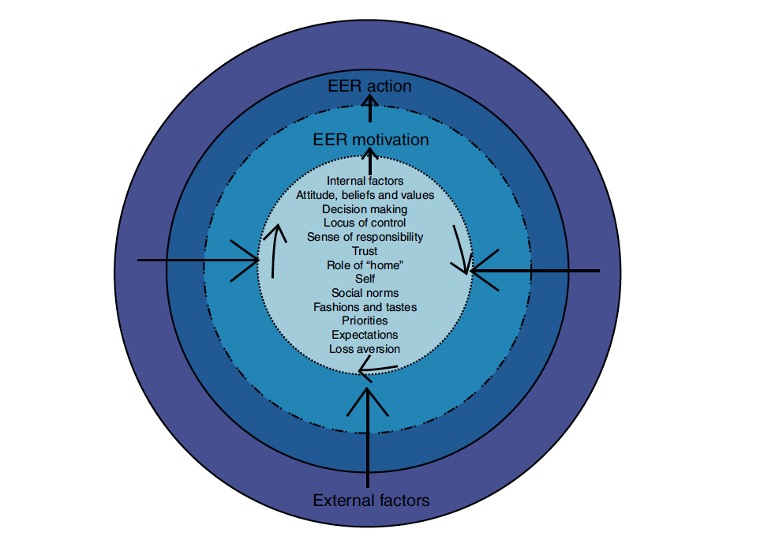

What are the motivations for energy efficient refurbishment (EER)?

Owner-occupier motivation is multifaceted and complex. It is the precursor to energy efficiency refurbishment (i.e. action) and to encourage a greater uptake such refurbishment better

Read MoreWhat are the motivations for energy efficient refurbishment (EER)?

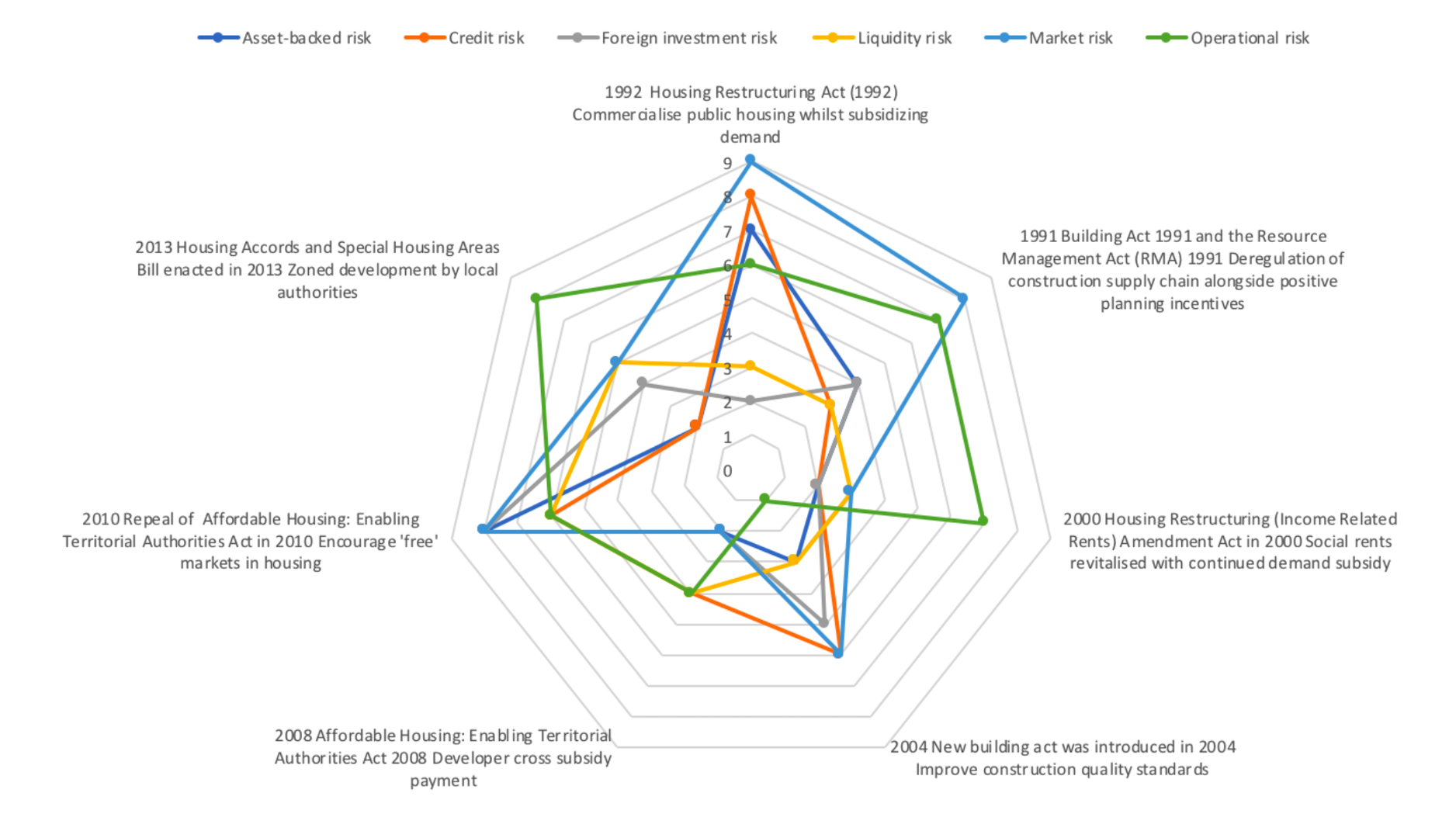

Mapping Financial Risk and Housing Trends in New Zealand: towards ‘freer’ in a largely free market?

For New Zealand, at a national scale housing policy trends have encouraged market engagement given its high proportion of residential ownership, with social housing provision

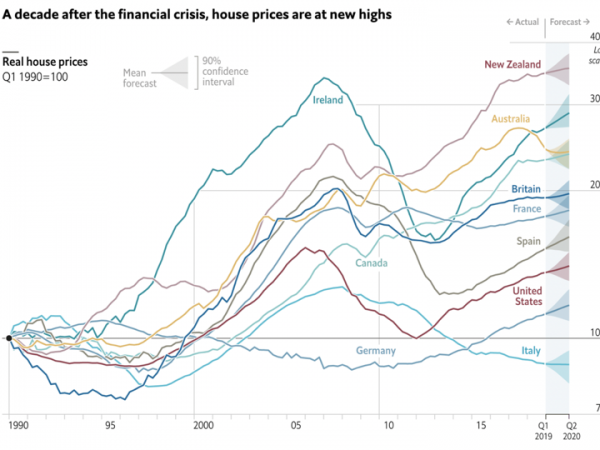

Comparative House Price Index

Interesting house price index from The Economist post GFC

Referencing Techniques

Software to help with referencing is a good way to build up and manage your own dataset of articles. Here are a couple of good

What is Research?

‘Research’ is a term that covers a multitude of activities, but in one way or another they are all about finding things out. At one

Towards Financial Risk and Housing Policy Trends

Institutions providing access to housing in all tenures have become further entrenched and exposed to financial risk. Literature on housing policy trends and financial risk

Resilience and housing markets: Who is it really for?

Ten years after the Global Financial Crisis, this research examines how resilience theory and rhetoric relating to the economy and housing markets has been translated into policy and

Read MoreResilience and housing markets: Who is it really for?

Improving water quality with rural land use policy: (re)balancing farmland regulation, intensification and financial viability

Policymakers in New Zealand are attempting to achieve improved environmental outcomes by implementing an output-based approach to non-point-source

Financing infrastructure development: time to unshackle the bonds?

It is important to consider the merits of using projects bonds to finance infrastructure investment projects – in particular, the pricing of such bonds and the level

Read MoreFinancing infrastructure development: time to unshackle the bonds?

Innovative real estate development finance – evidence from Europe

This research provides an insight into large-scale real estate projects in Europe and how they are using

Read MoreInnovative real estate development finance – evidence from Europe

Methods and models for international comparative real estate development

Real estate development is a significant factor in planning the built environment. It shapes

Read MoreMethods and models for international comparative real estate development

Dysfunctional Neighbourhoods Exist: More Urban Regeneration Needed

Neighbourhoods within area-based initiatives that are engaged with regeneration and renewal often experience difficulties of poverty, disadvantage

Read MoreDysfunctional Neighbourhoods Exist: More Urban Regeneration Needed

The difference between property bonds and leases – and the consequences for healthcare.

There are some 487,000 places in long-stay residential care and nursing homes in the UK representing an

Read MoreThe difference between property bonds and leases – and the consequences for healthcare.

Innovative Development Finance in Europe

A critical review and analysis of innovative financial instruments for real estate development in Europe will be useful to EU and European national policy makers

Lessons in finance bonding for affordable housing

Can finance bonding be centred more on affordable housing as well as infrastructure? Some interesting nuances and lessons can be drawn when using a Tax Increment

Is Building Heritage in Enterprise Zones The Latest Threat or Opportunity?

In considering heritage for buildings within Enterprise Zones, the central premise has been focusing on economic growth, with less thought given to the wider structural and cultural

Read MoreIs Building Heritage in Enterprise Zones The Latest Threat or Opportunity?

Returning to Rousseau – Is there a Contract Between Citizen and State?

New forms of governance, conditional approaches to public service access, and initiatives to engage citizens in taking on new responsibilities

Read MoreReturning to Rousseau – Is there a Contract Between Citizen and State?

A housing numbers game? The new housing quality design challenge

The last 15 years has seen significant changes in the location, type, delivery and design of urban

Read MoreA housing numbers game? The new housing quality design challenge

Solutions to the housing crisis – Housing Associations in the Private Rented Sector?

How do housing stakeholders align future private and public spending to identify investment opportunities and help meet the City’s broader economic and spatial

Read MoreSolutions to the housing crisis – Housing Associations in the Private Rented Sector?

Future financing cities through planning and development

It is important to improve understanding of how cities can be better financed to meet challenges over the short and long-term; be they economic, social

Read MoreFuture financing cities through planning and development

Urban water economics – putting a value, price, and cost on natural resources

Environmental resource issues involving water need to consider third-party external costs (and benefits) – water pollution being one example. Natural resource economics can be applied to this issue and set in

Read MoreUrban water economics – putting a value, price, and cost on natural resources

Motivations for energy efficiency refurbishment

The existing housing stock needs substantial adaptation to meet national and international carbon reduction targets. The largest proportion

Community self-build schemes enabling holistic solutions for ex-servicemen

It is worth looking at the impact of community self-build schemes, especially as many have helped ex-service personnel rehabilitate

Read MoreCommunity self-build schemes enabling holistic solutions for ex-servicemen

Should developers pay for public goods and services ? The Community Infrastructure Levy (CIL)

If the public purse is being squeezed we should start thinking about whether private resources should be used to fund public goods and services. When

Lessons need to be learned from Enterprise Zones and Empowerment Zones

There is a need to learn lessons when using spatially targeted fiscal experiments if intervention is to generate wider developmental benefit. For Enterprise Zone concept

Read MoreLessons need to be learned from Enterprise Zones and Empowerment Zones

Tax Increment Financing (TIF) as an urban policy for spatially targeted economic development initiatives

Urban policy transfer between the US and UK has long been of interest to researchers and practitioners. Given the recent wider context of reduced direct

Low Demand Neighbourhoods – Housing Market Renewal Experience

I completed a PhD from the University of Manchester (2009), that predominantly focused on exploring the drivers and dynamics associated with what I termed ‘low

Read MoreLow Demand Neighbourhoods – Housing Market Renewal Experience

Transcendental Meditation (TM)

I have been practicing transcendental meditation (TM) for nearly 2 years. It was one of the best decisions I have