[2000 Words; 15 Minute Read] Policy in affordable housing supply is responding to the challenge of housing markets where unaffordability prevails. Often measured by high income to house price ratios. The United States’ approaches to affordable housing supply often look at what mechanisms are practically used as subsidy. This post has a focus on a critical United States federal policy that aims to improve the ability to finance affordable housing – The Community Reinvestment Act (CRA). Transnational lesson learning and international policy transfer can be considered when transplanting this type of affordable housing policy intervention elsewhere. The CRA is the core United States policy that enables affordable housing supply. Towards these aims, CRA policy here is introduced as an affordable housing supply policy, followed by an introduction of a ‘reinvestment’ conceptual approach.

Findings incorporate professional stakeholder interviews on location in San Francisco. Findings show that affordable housing supply is enabled when used in an appropriate combination of policies and that the CRA acts as a demand-side subsidy enabling subsidies on the supply-side. The discussion surrounding reinvestment policies such as the Community Reinvestment Act (CRA) provides some guidance as to reinvestment providing some solution to an investment problem in affordable housing supply. Especially if a demand-side subsidy (e.g. CRA) can be matched and enable in synergy with other supply-side subsidies. Demand-side subsidy thinking adds weight to further developments in the research agenda that can look at demand and supply subsidies in the affordable housing market. Only then can unaffordable housing be tackled in a more sophisticated and robust manner.

Affordable Housing Supply Policy – Introducing the Community Reinvestment Act (CRA)

The Community Reinvestment Act (CRA) can be explored as to whether it is the most effective monetary policy enabler of affordable housing supply in the US. This is particularly used for targetting low-income households that have affordability problems. Mortgage relief and tax exemption are often for more affluent home-owners and hold the greatest subsidy for high-income earners. With a CRA investment approach, we see targeted community reinvestment that enables affordable housing for low-income earners. The broad remit of the CRA is worth spelling out here:

“This law requires depository institutions above a minimum size to serve the credit needs of all the communities from which they draw deposits. The law requires the three federal bank regulators (Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, and the Federal Reserve Bank) to evaluate an institution’s lending, investment, and other services throughout the communities it serves, including low- and moderate-income areas. Failure to provide adequate services can be grounds to reject the lender’s application to acquire or merge with another institution, to open new branches in new areas, or to engage in other regulated activities” (Schwartz, 2014, pp. 362).

Further, in terms of the mechanics of to whom the CRA benefits, and by what criteria (for affordable housing supply), it is set within parameters where:

“CRA-eligible loan shares include loans to borrowers earning less than 80 percent of the area median income and/or loans made on properties in census tracts to borrowers with incomes less than 80 percent of the metropolitan statistical areas (MSA) median as of 1990” (Agpar and Duda, 2003, pp. 183).

To consider strengths and weaknesses, the CRA ‘works’ by putting local obligation of banks into focus, plus the law allows communities to challenge any breaches. However, the checks and balances are seen not to have enforcement power pressing from federal top-down institutions. Despite the CRAs ability to open up access to capital it is simultaneously being swallowed-up by wider mortgage channels that are being opened up, as well as a diffusion in CRA impact due to many institutions offering low-come borrowing outside of the CRA regulatory framework (Agpar and Duda, 2003).

Macey and Miller (1993) argue that the ‘statute allocates credit inefficiently, impairs the safety and soundness of depository institutions, imposes significant (and steadily increasing) compliance costs, selectively taxes depository institutions over competing firms” (Macey and Miller, 1993, pp. 347). That said, the authors do not acknowledge that paying for external social costs may be the cause of this inefficiency claim. Further study would require exploration into notions of efficiency such as Pareto Efficiency, when one person cannot be made worse off by the improvement of another.

Critiques see the CRA more normatively argued as having continued importance to deal with market failure as per the inefficiency argument (Barr, 2005). This support is countered in a more positivist sense in that a form of redlining (or geographically based discrimination) still occurs with CRA regulations, as more favoured applicants are correlated to more affluent groups who are able to obtain Private Mortgage Insurance (PMI) (Ross and Tootell, 2000).

Bringing the CRA in more contemporary debate and some sign as to which way it is heading, Saadi (2016) considers that the appetite for community reinvestment may now depend on the broader financial context and housing cycle. For example, in a post-Global Financial Crisis (GFC) landscape, financial institutions may have less incentive to reinvest into the community. More theoretically, the principles of the CRA still resonate around contemporary ideas of fair lending. More practically, the fair lending policy still underpins what the CRA intends to deal with. Immergluck (2016), firmly considers that in the twenty-first century, community reinvestment is a worthy pursuit if more practically the goal is to enable ‘access to fair credit’, rather than a ‘fair access to credit’. Thereby, placing importance and power onto the institutional system to create fair credit, rather than on individuals finding ways to fairly access credit which they may have limited power.

Concepts: A Reinvestment Model

To generate sustainable affordable housing supply that is less than the market rate, profit or surplus generated by affordable housing providers need to be returned to the organization to reinvest in further properties. This surplus approach underscores the balance of commercial and mission-based interests when supplying affordable housing. Commercial and social mission balance are intertwined in the reinvestment components of banks and financial institutions that (re)invest in affordable housing projects. On the one hand, financial organisations are seeking rewards on investment, but it is market-shaping forces of financial regulation (such as the CRA) that incentivize investment into low-income communities and neighbourhoods. In effect, reinvestment type regulation can act as an affordable housing subsidy, as it enables low-income households to access housing that would otherwise not be built at market rate.

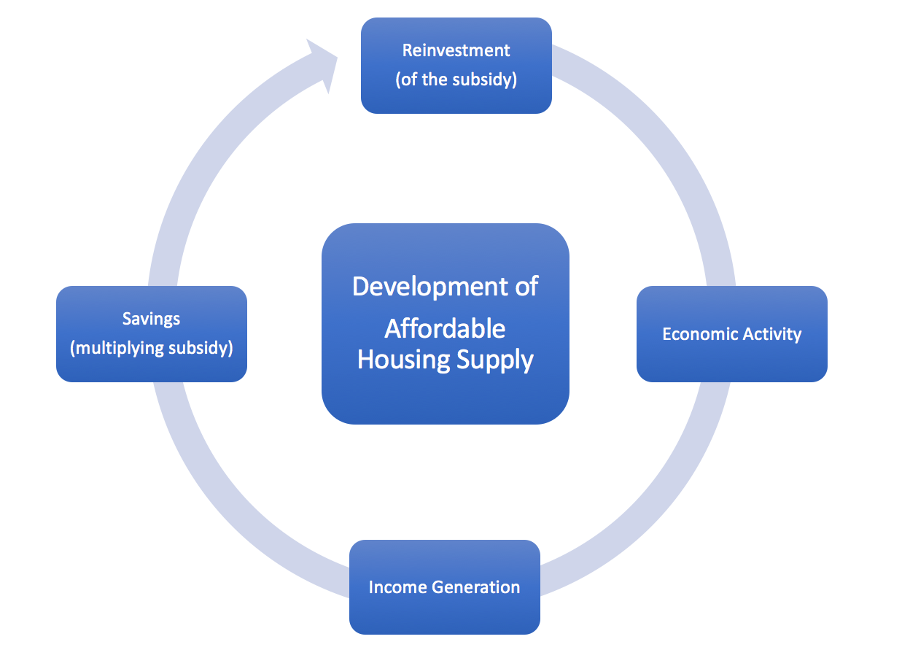

The reinvestment also catalyses the supply of units that would be far higher full market value. The virtuous circle in providing affordable housing supply from a reinvestment-surplus conceptual perspective demonstrates how affordable housing develops through further economic activity in the neighbourhood, further income generation, further savings that have multiplied (including a multiplied subsidy), and thus further reinvestment by the developers and the institutions that serve them (Figure 1).

Figure 1: Virtuous cycle of the reinvestment-surplus concept model for the development of affordable housing supply

Findings and Analysis

In many discussions during the research the CRA was often perceived as a principal lead policy in enabling affordable housing. Particularly that the Act encourages fair lending to low-income groups based on sound judgement and non-predatory practice, in return for good credit scores by financial institutions. To underscore the importance of CRA credit lending in the affordable housing sector as a whole, several professionals highlighted the more commercial incentives that enabled the subsidy:

“What we’ve found there are some companies like [X] that are really strictly in it because it’s good business. Some corporations like banks, the US Government has what they call the CRA Act, the Community Reinvestment Act. They have requirements that every bank has to satisfy with respect to investing in affordable housing. We have found that it is a business where we can make an appropriate profit for the risk that we’re taking” (Interviewee).

In this sense, the CRA acts more as a demand-based subsidy at a local level for those taking out loans to purchase and build properties. Thus, we argue here is more of an affordable housing demand-side subsidy enabler, that by its nature begins to move outside of the remit of this article on affordable housing supply. What can be discussed through is the CRAs importance not as a stand-alone policy but in its relation to and combination with other policies that may bolster the enablement of affordable housing supply. This is particularly true of CRA lending practices that co-join with tax credits to enable supply-side affordable housing subsidies for the not-for-profit component of the development project. As explained by the banks and developers respectively, there is a synergy beyond the CRA once tax credits are exchanged to finance affordable housing supply.

“The size of our loans range from 5 Million [US Dollars] at the low end to hundreds of million at the high end. You can’t grant that kind of money, because, well, the bank would go out of business if you were putting money out like that. So it’s structured where we’re not going to lose money and we’re going to make a return for our investors. Then as an added benefit, we get CRA credits to do this business” (Interviewee).

“So when we go in to do a project like this one, we’ve got free land, we’ve got a cheque from the developer, then we use low-income tax credits…Basically, we get an allocation of federal credits. Because [X] is a non-profit, we can sell those credits to a for profit company. We form a limited partnership, they give us an upfront investment of cash in exchange for our keeping the building affordable for 15 years. At year 15, they get to exit” (Interviewee).

As an interesting counter to the idea that the tax credits work together with the CRA in providing subsidy for affordable housing supply, it is noted that banks would still lend even if the Act was not there. It is noted that a loosening of the CRA would open up more exposure to predatory lending, reductions in the subsequent use of tax credits and a scaling back of affordable housing supply policy enablers:

“Banks work on hitting the CRA – meeting their CRA obligations in many ways. But in the affordable housing field, it’s two primarily. One is just the traditional lending, particularly – it’s really the construction loans. Then the other is the tax credits…if the credits went away, if there weren’t viable affordable housing execution, the banks would still want to lend money…So the dirty little secret is the banks really aren’t interested in the tax credits themselves. It’s the CRA button for them, I think…The point being, the banks would be happy to get rid of the tax credit so long as the government then eased the CRA burden accordingly.” (Interviewee).

Discussion

With a message that reinforces the central context of unaffordable cities being one as an investment problem, the solution of reinvestment is key. Although the policy of a Community Reinvestment Act (CRA) has weak enabling capability on its own, it has catalytic enablement to synthesise many other subsidizing policies. The CRA has been waning in its enabler capacity, especially as enforcement has become more lackadaisical (Fishbein, 1992), and credit institutions have become more prevalent and competitive (Agpar and Duda, 2003). Further, despite the direct critique of economic net losses (Macey and Miller, 1993) and regulatory sidestepping to ensure insurance based on financial standing (Ross & Tootell, 2000), we see a CRA now over 40 years in maturity, that could in principle meet affordable housing supply that is not sub-prime lending (Saadi, 2016), whilst enabling access to fair credit.

This reinvestment policy could extend and support the supply of affordable housing. Particularly if the CRA and/or other reinvestment approaches more broadly encourage a plethora of subsidies to provide less than market value housing as an outcome. What is of focus here is that CRA can also be considered a demand subsidy, in that it enables catalytic further supply subsidies by its use. Further research should explore demand-based subsidies in combination with supply-side subsidies to uncover a market for affordable housing based on subsidies. Noted though that the pitfalls of demand-side subsidies for affordable housing is exemplified in mortgage relief for more affluent owner-occupiers. This will certainly take the affordable housing debate to a level beyond solution rhetoric of supply-side solutions (not subsidies), that are often purported as simply building more cheap units to solve a wider unaffordable housing problem in cities.

Conclusion

Within the context of unaffordable cities, we have argued that affordable housing supply is enabled through a combination of policies. These policies centre on subsidies, largely explored on the supply side in this research to determine the bricks and mortar possibilities to build less than market-rate housing. In the United States. The Community Reinvestment Act (CRA), now over 40 years in maturity, only partially enables affordable housing supply. As the CRA needs bolstering and is more of a demand-side subsidy in nature. Although it is maintained that without such demand-side policies, other combinations of supply-side subsidies would not have an enabling capacity. The future of research into unaffordable cities can be taken forward with serious theoretical and policy purpose once this subsidy enabler focus on affordable housing is taken up.