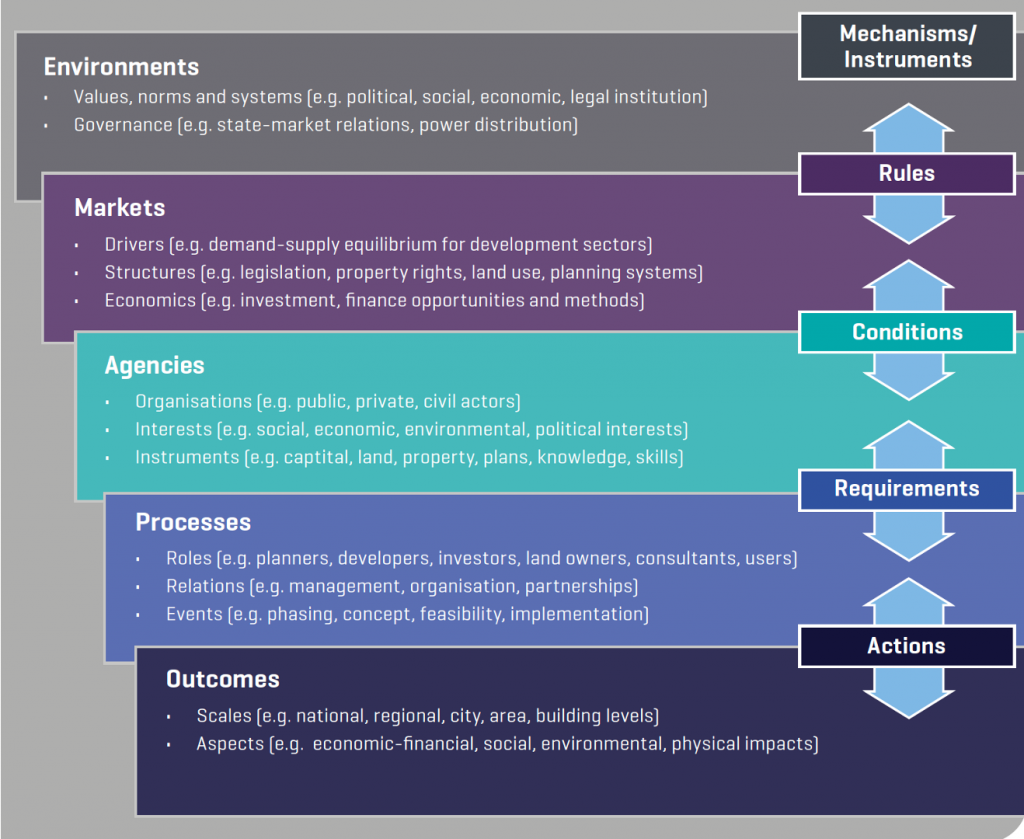

Approaches to international comparative analysis of real estate development can be used to bring out some comparisons in case study sites. Key layers and mechanisms that can be used to make such comparisons and highlight the investment and finance opportunities that are found in different property market contexts.

From this model, comparisons in the financing of real estate development can be made within the realms of the structural environments (systemic and non-systemic), the market, the agencies, the process, and the anticipated and actual outcomes that occur.

Cross-cutting between these realms are the mechanisms that enable finance in real estate development happen. Mechanisms are interpreted as the financial instruments for real estate development in regeneration – such as the institutional rules, market conditions, agency requirements, evaluations and actions.

In applying this comparative analysis approach to the case studies, a series of layered elements (environments, markets, agencies, processes, outcomes) and mechanisms/instruments (rules, conditions, requirements, actions) can be compared and contrasted against each other in order to identify similarities and differences, and gain a greater insight of what can be considered as innovative in real estate development.