[1000 Words; 5 Minute Read] A Public Private Partnership (PPP) is a public service or private business venture that is funded and operated through a partnership between the public sector (either central or local government) and one or more private sector companies. PPPs are recognised as a key element in a government’s strategy for delivering modern, high quality public services and promoting competitiveness. The use of private financing in public projects is one element of PPP business structures and partnership arrangements. Others include joint ventures, outsourcing, and the sale of equity stakes in state-owned businesses. The introduction of private sector ownership into state-owned businesses can have a full range of possible structures. The structure could for instance be brought into existence through floatation or the introduction of a strategic partner. Either public or private sector interests can hold major or minor stakes in the PPP. The importance of PPPs to building procurement is the amount of funds and policy support that is directed at the construction industry in using this model of partnership.

PPPs are therefore a particular type of contractual arrangement between the public sector and private sector firms. They give the private sector a greater role in financing, building and maintaining public sector facilities, although the government retains a stake in the PPP Company. Under public private partnership arrangements the government is not liable to a fixed stream of annual payments. PPP is therefore an arrangement that can be financed via both public sector and private company sources. For instance, a partnership contract can be drawn up that recognizes agreed government funding and private developer contributions to a project.

With the introduction of the private sector in PPPs, advantages for the public interest are maintained if fundamental government roles are made responsible and held accountable for. Fundamental roles for the government include being the principal decision maker between different competing objectives. This then allows the government to retain authority as to whether the objectives are delivered to the standards required. Most importantly the fundamental government decision-making should in theory ensure that the wider public interests are safeguarded. Public interest issues would be those such as putting in place regulatory bodies that remain in the public sector, maintaining safety standards, and ensuring that any monopoly power is not abused.

Budget overspend is often a feature of large scale Public projects. PPPs often deal with the need for either more accurate projections or improved procurement methods in such projects. This is not to say that initial budgets are initially kept artificially low, but budget are often projected low in the first instance to ensure projects using public money win the bid and get the go-ahead in the first instance.

With public criticism of public sector overspend, some recommendations in re-thinking procurement are the introduction of equitable due diligence in public procurement as is carried out in private business. Moreover, there is a call to involve rigorous expert scrutiny not just at the point of purchase, but also throughout the life cycle of public sector procurement projects. The recommendation to incentivise procurement in the public sector is especially significant. Particularly as it is stressed that procurement should not just be a ‘sell off’ by emphasising that public sector parties benefit from the innovative approaches developed by private sector partners in PFI deals.

The complexity and intricacies of integrating private sector risk into procurement has meant that more sophisticated PPP design structures have come into existence. One example being the use of government backed bonds on projects and partnership organisations. This finance approach is held with caution as the raising of finance through bonds issued by state-owned businesses or bonds guaranteed by government does not always offer best value. It is more cost-effective for governments to issue (non-guaranteed) gilt-edged securities (or gilts) to directly finance projects as they offer less guarantee and more risk but as a result can offer greater reward – therefore generating greater initial funds to finance the project. Avoidance in increasing the public sector borrowing is also enabled through the direct issue of government gilts into the financial market – rather than state-owned businesses issuing bonds for the direct financing of its PPP projects.

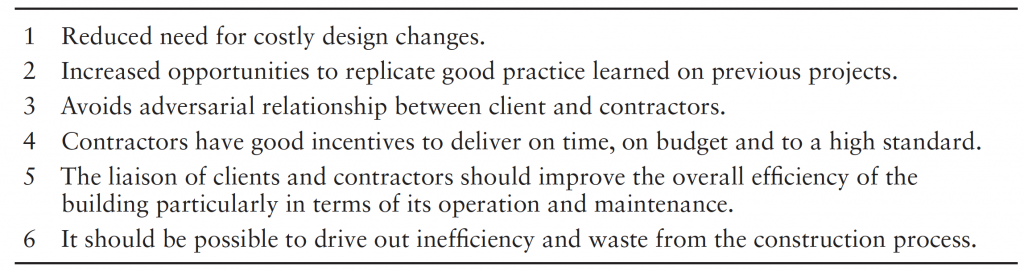

More generally, partnering in any form of procurement is an attractive idea and in economic terms it helps to eliminate inefficiency as costs per unit of output are reduced. Leibenstein’s (1973) concept of x-inefficiency can be applied here. This is where the decisions of an individual public sector authority or an individual contractor are less likely to maximise the value of output. Particularly when applied to decisions chosen on what to build, how to build it, and how long to spend on the project. Partnering also improves the dynamics of the market by putting the client more in control and improving the flow of information between the participants. Partnerships can also provide the platform to provide greater incentives to complete the contract on time, to budget and to the expected quality. Some of the benefits of partnering are summarised in Table 1 on how industry could become more efficient.

Table 1: The Benefits of Partnering

Contemporary issues surrounding the partnership industry involve the reduction in credit available to finance projects and the subsequent programme delays and new deals being signed. Many deals take a fall in direct correlation to credit and economic cycles. For instance, in a downturn in credit available, banks no longer feel able to take on large chunks of debt, and the cost of finance can sharply rise. For further discussion, against this backdrop of a shrinking public purse and a tight financial market, is a focus on the critical procurement decisions made by both public and private stakeholder partners.

Summary

- PPP is public service or private business venture that is funded and operated through a partnership between the public sector and private sector companies.

- PPP is an arrangement that can be financed via both public sector and private company sources.

- Benefits are argued in a reduction of procurement costs and a reduction in project delays

- The complexity and intricacies of integrating private sector risk into procurement has meant that more sophisticated PPP design structures have come into existence such as introducing specific project bonds

- Avoidance in increasing the public sector borrowing is also enabled through the direct issue of government gilts into the financial market – rather than state-owned businesses issuing bonds for the direct financing of its PPP projects.

- Partnering seen as more efficient process than individual sector projects due to x-efficiency.

This is an updated and edited excerpt from my book. Please cite:

Greenhalgh, B. and Squires, G. (2011). Introduction to Building Procurement. Routledge.