[2000 Words; 10 minute Read] The Private Finance Initiative (PFI) is defined as a form of procurement to encourage private investment in public sector projects. As an example, for the United Kingdom, it was introduced as a government programme that required all new public sector capital expenditure proposals to be tested to see if private sector suppliers could replace them. This programme was set against the backdrop of continued government objectives of decentralisation and liberalisation of markets. It also held the belief that private businesses are innately better than the public sector at decision-making, cost-reduction, risk-taking and organisation. Decentralisation has also been part of wider processes and forces beyond policy objectives with the increase in downsizing and outsourcing. Decentralisation has also taken a surge largely due to developments in information technology. Support for PFI projects continued with the acceptance that there should be private sector participation in public projects.

The purpose of PFI is to persuade the private sector to put capital into public services. PFI as a form of partnering has a high profile as it represents public and private sectors collaborating over some of the biggest projects. Building projects in PFI tend to be large- scale initiatives in the public domain such as highways, hospitals, prisons, schools, airport extensions, power schemes, rail-lines, water treatment plants and government offices. In effect, PFI procurement creates a far better level of communication between public sector clients and private sector contractors, as both sides are linked by a common objective. The collaborative agreement provides mutual benefits to both parties. It should be noted that joint working between sectors has a reasonably long history and is not entirely a new phenomenon. For instance, in housing, local authorities have transferred the ownership and management of large estates to a government-regulated private-sector group of registered social landlords.

Under PFI the purchaser does not immediately acquire the assets but puts in place a contract to buy services from the supplier. This means that a supplier, or group of suppliers, acquire the assets involved (e.g. build a school) whilst being secure in the knowledge there will be a customer for its services (e.g. local education authority). The assets concerned may remain with the supplier for a long period of time that may run up to thirty or forty years. Depending on the contract, the assets may then be transferred to new owners such as a public sector agency or to a new private operator. Typically, PFI suppliers are contracted not only to finance and build a facility but also to design and operate it. The supplier may additionally provide infrastructure and support services for a period of several years following construction. The forming of PFI can therefore be a complex process, and Table 1 demonstrates the steps that can be taken to guide through a PFI project.

TABLE 1: Step sequence Task

1 Clarify objectives by establishing a business need

2 Appraise the options

3 Produce outline business case

4 Assemble project team

5 Decide tactics for selection stage

6 Invite bids by issuing contract notice

7 Prequalification of bidders

8 Selection of bidders (shortlisting)

9 Reappraise business case and refine

10 Invitation to negotiate

11 Receipt and evaluation of bids

12 Selection of preferred bidder and final evaluation

13 Award contract and financial close

14 Manage contract

Arguments in favour of PFI are that it is a way of keeping down taxation by encouraging more efficient private enterprise. Alternatively, it can be argued that PFI is simply a quick trick to cut spending and remove public expenditure from public sector borrowing. Further arguments against PFI are those that consider an absence of insider knowledge for suppliers that are aiming to meet the service needs of those procuring the product. For instance, it can be questioned whether a supplier of schools have sufficient insider knowledge and experience of what the local education authority needs to design, build, operate and finance a successful school. The premise for using PFI is therefore complex but its merits have not caused differing political groups to disregard it as a procurement tool.

Construction Procurement under PFI

A construction project procured under PFI is based on a new kind of relationship between a public sector client and a private sector contractor. As briefly mentioned, the general procedure for building procurement under PFI involves contractors, usually operating in a consortium, agreeing to design, build, finance and manage a facility traditionally provided by the public sector. In return, the public sector client agrees to pay annual charges during the life of the contract and/or allows the private sector to reap any profits that can be made for a specified period, which may last up to thirty years or more. In this way, both sectors can be seen to be specialising in what they do best: with the public sector client setting the agenda by specifying the level of service required and the private sector contractor determining the best way to deliver that service. These PFI arrangements have obvious advantages as the contractor manages elements of the contract meaning that the contractor has to live with the project once it has been built. When the private sector has money at risk in this way, there are far greater incentives to get everything right, especially as building contractors now have to consider the running and maintenance costs.

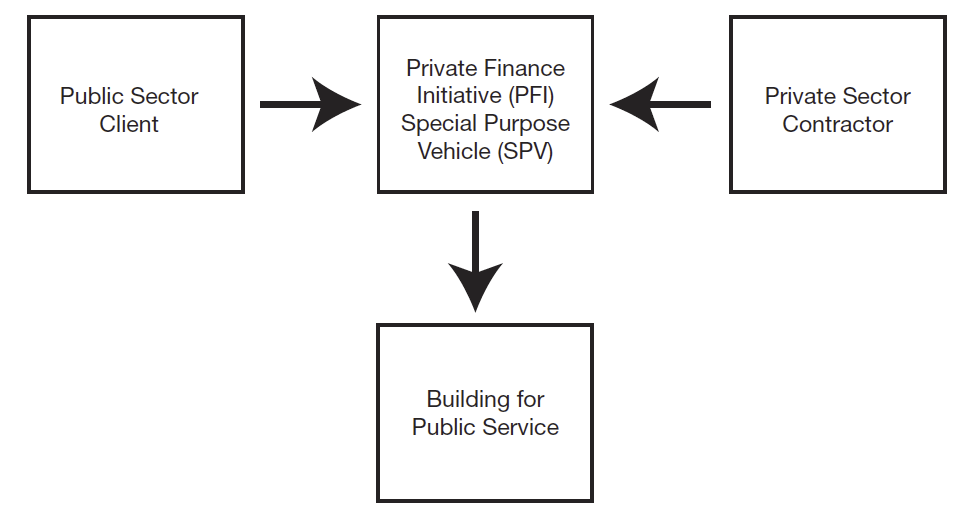

Figure 1: Structure of PFI procurement

The model structure of a PFI contains an element known as a Special Purpose Vehicle (SPV) (Figure 1). The SPV is the project company established by the sponsors who have the sole purpose of delivering a project. The SPV draws on requirements set by the public sector client and the private company contractor to ensure there is a successful building for use in public service. The value for money that a PFI funded project brings is particularly pertinent for those involved in building procurement. Key elements in whether value for money is reached are those such as competition and the cost of construction, cost overruns, risk, and if there is in fact any evidence of value for money.

Transfer of risk is a contributor to gaining value for money in building procurement and has been key to the use of PFI. Risks can be general but are often more specific and dependent on the project in question. The risk involved in a school project will differ to a highway project for instance. The important aspect relating to value for money in the public sector will be that for each project there is sufficient risk transferred to the private sector. The level of risk transferred can be subdivided into the transfer of disposal risk and external finance risk. The amount of disposal risk is the level of assets that are surplus to public service demand at the point of disposal. The external financial risk will be determined by the ability to raise sufficient funds on the open market. This will be intrinsically linked to the changes in interest rates as a greater than expected rise in interest rates will be detrimental to lending repayments. Transfer of risk also means that there is a possibility of the project failing which means that transfer should be given to those private organisations that are able to manage risk effectively.

A great deal of gloom has been cast more recently over the future of partnering using PFI. There have been repeated warnings by governments that construction’s capacity to take on PFI projects will dwindle as the costs of bidding begin to outweigh the likely rewards. It has also been pointed out that contractors tend to develop niche markets in, say, health and/or education and shun those sectors that are troubled by political tension. To compound these issues even further, a recent directive from the European Commission suggests that at least five consortiums need to compete in the final bid for major projects. This in turn could present yet another hurdle in developing and extending PFI and prime contracting arrangements. This highlights the economies of scale in partnering where it is easier for large firms to gain an advantage, and benefit further from partnering arrangements. Small firms generally lack the resources and expertise to participate in the lengthy bidding process involved in PFI contracts.

In construction where PFI is emerging, competitive market conditions do not prevail. Many firms lack the necessary resources to understand the complex legal information that is inevitably associated with these forms of procurement. Transaction costs are prohibitively high, with architects’, lawyers’ and accountants’ fees needing to be met by all the participating parties. As a result, it is unusual for more than three or four consortium groups to find sufficient resources to engage in the tedious, lengthy and detailed bidding processes involved. The firms that are able to take on such large-scale operations and risks are few and far between, and it is a common concern that partnering arrangements often exclude the smaller contractors.

Many issues doubting the use of PFI for building procurement can be seen to centre around high bidding costs, the cost of borrowing, and poor negotiation when refinancing PFI contracts. High bidding costs are often put down to high ‘front-loaded’ costs that are involved in organising and preparing a tender for a PFI project. The cost of borrowing may in fact be more costly from private funds as opposed to sources of finance that can be accessed by the public sector. PFI funds from the private sector may enable a greater variety of financial borrowing options but may not necessarily be cheaper than public sources. Public sources of finance are backed by tax revenues and often with less risk, and hence a cheaper way of acquiring funds.

Weak negotiation skills in drawing up PFI contracts are another issue that question the value for money when using PFI for procurement. For instance, some contracts allow a re-financing option for the private sector part way through a project. It can be argued that this re-financing option should integrate an option for the public sector client to be reimbursed. If not the private client will take some reward for any positive changes in the external financial market. Conversely, the public sector client will not be able to take a reward if they are not able to refinance during the project. For public sector clients to prosper from re-financing at stages during the project it will rely on the contract negotiation and legal skills held by public managers.

The longevity of PFI for public service building contracts has shown signs of waning in recent years. This fall in private sector investment in both private and public building is in part reflective of the economic cycles. Falls in GDP often create more volatile and initial ripple effects in the private sector. Future uplifts in the economy may reverse the rising proportion of public sector building projects. A growth of PFI funded projects may return if there are limited public funds to invest in building public services. The availability of public funds will be further stretched during times where there is pressure to reduce a country’s public sector borrowing deficits.

As for the future of PFI, it is argued that complexities in using PFI are currently more challenging due to a weak financial sector compared to previous periods. For instance, the financial sector remained relatively intact during the last recession. This time round PFI can be seen as the principal villain (in terms of toxic lending) and victim (in terms of failed initiatives) of contemporary economic development practices. The rather bleak view that the collapse of private credit has dragged the private finance initiative down with it has been challenged. For instance, it is argued that government- building programmes are so important to social and economic imperatives that a way will be found to build public infrastructure in the future.

During a time of restricted credit and finance, deals may more likely take the form of Public Private Partnerships (PPPs) rather than PFI, especially if the lack of liquidity is forcing the government to look at using PPPs far more broadly. There appears to be no halt in procurement from the private sector in building public sector projects. For instance, private healthcare is more common, there is rising council outsourcing, and there are talks of private firms running education authorities. Private money may indeed be funding more of public goods in the future.

Summary

- PFI is a form of procurement to encourage private investment in public sector projects.

- Set against a backdrop of continued government objectives of decentralisation and liberalisation of markets.

- Also part of wider processes of increased downsizing, outsourcing and developments in information technology.

- Under PFI the purchaser does not immediately acquire the assets but puts in place a contract to buy services from the supplier. The assets may remain with the supplier for up to thirty or forty years.

- Private investment may include the design, building, financing and operations as part of the public-private contract to develop the asset.

- A Special Purpose Vehicle (SPV) draws on requirements set by the public sector client and the private company contractor to ensure there is a successful building for use in public service.

- Value for money in PFI is reached depending on the level of competition, cost overruns, and risk

- Issues doubting the use of PFI for building procurement can be seen to centre around high bidding costs, the cost of borrowing, European procurement directives, and poor negotiation when refinancing PFI contracts

- Capacity to take on PFI projects may dwindle if credit restriction continues and asset values stagnate