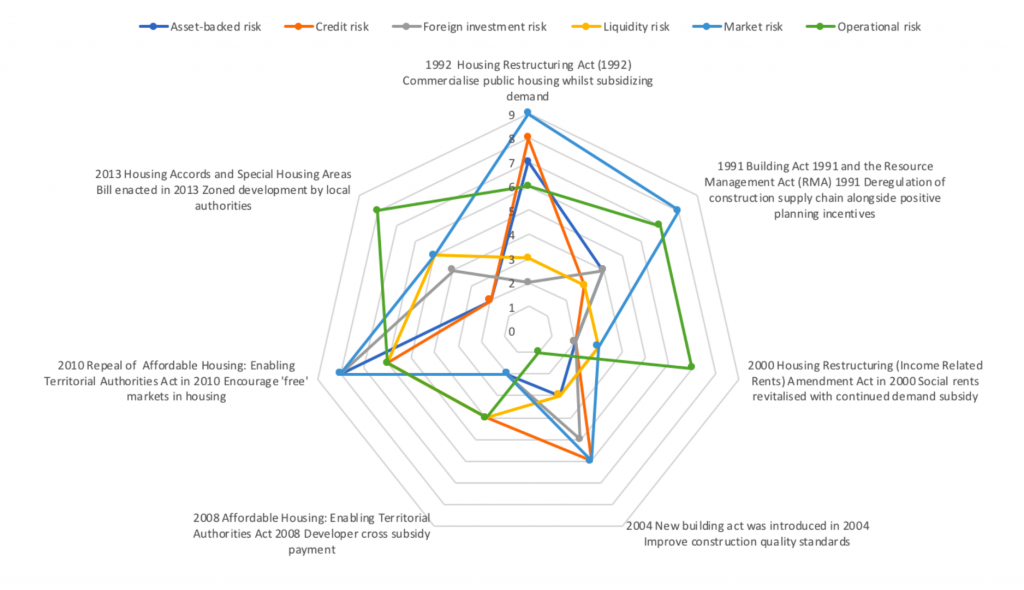

For New Zealand, at a national scale housing policy trends have encouraged market engagement given its high proportion of residential ownership, with social housing provision being more a concern for those in need. This is set alongside greater trend concerns over unaffordable housing for the middle class, as property prices have disproportionally risen against wages in many locations. Since 1992 as a timeline we have seen the commercialisation of public housing whilst being softened with demand side subsidies (1992, 2000). Housing policy trend intentions despite the financial economic imperative, have sometimes focused on the physical construction standards (1991, 2004) given the often-poor quality of build. Of more importance as mentioned has been attempts to deal with housing affordability and affordable housing, driving sub-set intentions such as encouraging developer cross-subsidies (2008), a repeal of the affordable housing act (2010), and zoned approaches to try and spatially contain the problem (2013). In mapping these trends against the financial risk, the risks are interestingly mixed, although we see a significant increase in market risk at points of intention to commercialise public housing (1992), a deregulation of construction supply chain (1991), and the push to make the housing system even ‘freer’ in a largely free market (2010).